Welcome to the Introduction.com newsletter

Where 🚦 Signal > Noise 🔈

You’re now reading the same newsletter trusted by founders, investors, and executives across Coinbase, Stripe, A16Z, and the top L1s in crypto

Introduction.com is a private members' network for the operators shaping this industry behind the scenes

300+ members. Zero fluff. Just direct access to what matters

(ps, we just started reviewing applications. Keep an eye on your inbox.)

Introduction.com Updates (Members):

Members Only Portal: Later this week, we will be releasing the Introduction.com Members portal. This will be the new hub where all members will be able to access their benefits, private experiences, discover their fellow members, and access all other resources available to them. Take a sneak peak:

Introduction.com Members Portal

Introduction.com x Silicon Valley Bank: Members Only Dinner (NYC):

The Introduction.com team is excited to announce our first IRL, members only, event in New York City.

A closed-door gathering of top founders, investors, and operators from across Web3, AI, and fintech.

Hosted in partnership with Silicon Valley Bank and Introduction.com, this event is designed for high-value connections and meaningful relationships.

No panels. No pitches. Just curated introductions, deep conversations, and access to the people shaping the next decade of innovation.

Attendance is strictly by invitation.

Introduction.com x Silicon Valley Bank Members Only Soiree Powered by Arcadia

👶 New Member Announcements:

The Introduction.com team is super excited to announce the newest additions to our community this week!

(We’d love to see you up here one day🤠)

Apply Today

Aaron Ahmadi @ Rumi Labs

Aaron is the Head of Marketing at Rumi, where he’s focused on building innovative ways to capture and activate cultural data from streaming. With a background spanning brand strategy, digital marketing, and partnerships, he brings a versatile perspective and creativity to the group. Excited to have him on board.

Table of Contents

What We’re Looking at 👀

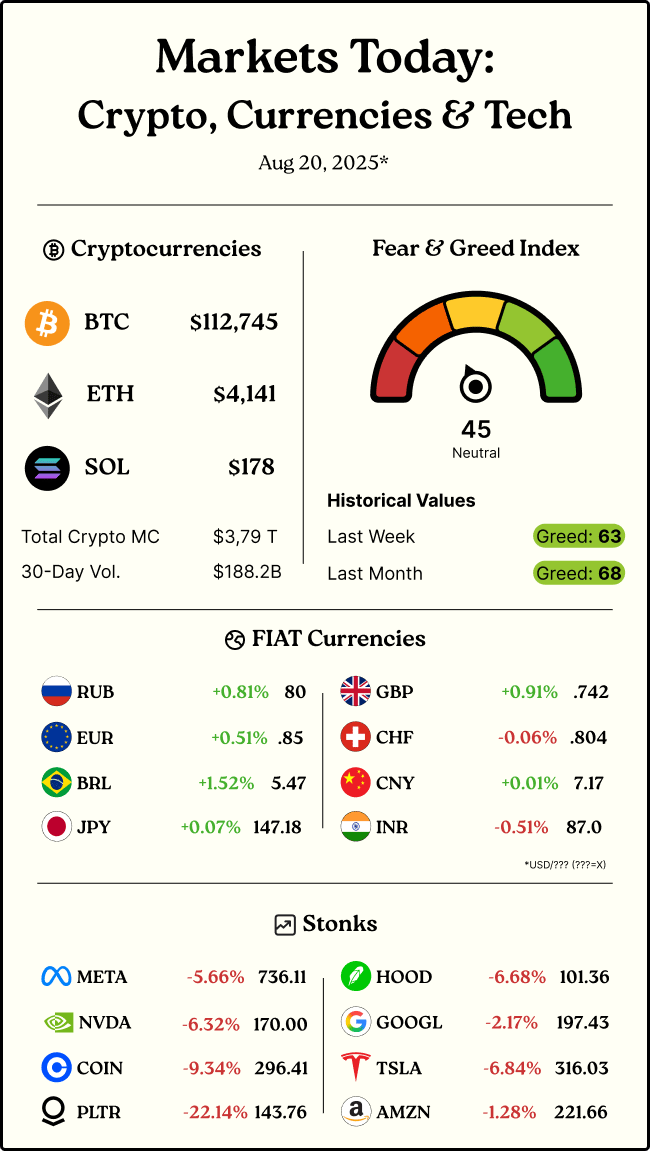

🌟 Markets are shifting fast, and this week’s headlines tell the story: Robinhood bets big on prediction markets, Bullish storms Wall Street with a billion-dollar IPO, and Mesh quietly locks down the rails that could power tomorrow’s payments.

From Web3 gaming’s China unlock to Ethereum’s Layer 2 comeback stories, the throughline is clear: the lines between trading, betting, and payments are blurring, and the winners are those building the pipes for the next wave of capital flows.🌟

Money Moves(Funding/M&A): 🤑

From Introduction.com Members 💳

Mesh

$9.5M Mesh’d together in latest funding round.

Funding Flash 💰

Mesh raised additional capital in August 2025, pushing their total funding beyond $130M.

PayPal Ventures lead the round by doubled dipping, adding additional capital since their previous investment in the company.

Amman Bhasin, said Mesh “has shown they can deliver the security, compliance and scalability that enterprises demand.”, highlighting its mass institutional appeal.

Earlier in 2025, Mesh pulled in $82M in a Series B led by Paradigm, with participation from Consensys, QuantumLight, and Yolo Investments.

The latest round shows repeat backing from PayPal Ventures and Galaxy Ventures, alongside fresh support from Coinbase and Bybit’s parent Mirana.

Who Is Mesh 👤

Mesh is a payments company that turns crypto into spendable money. A user can pay with Bitcoin, Ethereum, or another token, and Mesh instantly converts it into dollars or stablecoins so the business gets paid in the currency it already uses.

For merchants and platforms, it means they can accept crypto without adding wallets, exchanges, or extra steps.

How Mesh Works ⚙️

Connect your source: Users link their DeFi wallet through Mesh.

Choose what to send: Mesh’s API lets you pick the asset you hold (ETH, BTC, USDC, etc.) and what you want the recipient to receive.

Preview the route: Mesh shows a live quote for converting into the target currency, including expected amount and fees.

Risk checks first: A Transfer Risk Engine scans for errors like wrong network or missing gas before execution.

Convert and settle: Funds are swapped into the merchant’s or project’s preferred stablecoin and instantly sent on-chain.

Clear confirmation: Both sender and recipient see final settlement details, simplifying reconciliation and records.

Proof of Pay(Pal) 💸

Mesh powers crypto payments for hundreds of millions of users across platforms like Coinbase, MetaMask, Binance, and more than 300 others. This new funding will help them expand further by onboarding additional merchants and verticals.

The raise itself doubled as a live demo, with PayPal executing it in PYUSD through Mesh’s own rails, proving the speed and frictionless flow of stablecoin payments.

Looking Ahead 🔮

Expect Mesh to pilot deeper with PayPal’s PYUSD ecosystem and push into corporate payments, loyalty programs, and cross-border remittance flows.

The bigger play? With this funding and partner base, Mesh is not just enabling payments, it is competing for control of the very rails that will power tomorrow’s global money movement.

Industry Leaders 🤠

Bullish

Another Bullish IPO 🐂

News Flash 🗞️🚨

Bullish raised a staggering $1.11B in its NYSE debut, pricing its shares at $37, well above the initial $32–$33 range.

The IPO placed Bullish at an estimated $5.4B valuation, buoyed by backers like Peter Thiel and institutional heavyweights.

Roaring Day 🦁

Shares opened around $90, roared to a high near $118, and then settled around $68, reflecting overwhelming investor demand.

Who’s Bullish ❓

Bullish is an institutional-grade crypto exchange, powered by former NYSE president Tom Farley, that also owns CoinDesk. It offers spot, futures, and derivatives trading and positions itself as a regulated and enterprise-ready platform.

Bullish handles massive daily and annual volume: averaging $2.55 billion a day in Q1 2025, up 78% year-over-year, and totaling $250 billion in 2024 trading volume.

It outpaces traditional peers on volume: with $2.6 billion average daily volume, Bullish surpasses platforms like Coinbase and Kraken, signaling deep institutional liquidity.

Its key differentiator is regulated trust and transparency: Bullish operates as a fully reserved exchange audited by Deloitte, maintains 1:1 customer asset backing, and holds tier-1 licenses (e.g., Gibraltar GFSC), offering deep liquidity with near-zero spreads.

Bullish vs 👊

Bullish sets itself apart by targeting institutions first, blending deep liquidity and automated market making with strict compliance that rivals traditional venues. Unlike Robinhood’s retail focus or Coinbase’s hybrid model, Bullish positions itself as the crypto-native NYSE, purpose-built for large, regulated capital flows.

Circle (June 2025):

A mega debut, shares doubled on Day One and peaked near $299.

Gemini (Upcoming Filing):

Gemini’s IPO filing revealed a $283M loss on $69M revenue.

Looking Ahead 🔮

🚦Institution-first exchanges are carving out a durable lane in the crypto market.

With its blend of automated liquidity tech and strict compliance, Bullish is betting that the next wave of capital inflows will come from pensions, sovereign wealth funds, and asset managers who need crypto rails that look and feel like Wall Street.

If successful, it sets a new benchmark for how exchanges transition from startup to public markets.

The IPO isn’t just about Bullish raising money, it’s a test case for whether the market believes in crypto’s maturation into the global financial system 🚦

Neon Machine (Shrapnel)

Lookin’ Sharp 🪒

Neon Machine raised $19.5M in two rounds. Bringing the total raised to $57M, Shrapnel’s looks towards a global launch and regulatory-compliant China expansion.

The funding was led by Gala Games, with support from Griffin Gaming Partners and Polychain Capital.

Eric Schiermeyer, CEO of Gala Games, framed the investment as “a milestone for global gaming and for Shrapnel. By leading this round, we are backing Shrapnel’s entry into China’s vast market and its vision of thrilling gameplay with true digital ownership.”

Market Overview 🗺️

The Web3 gaming and NFT boom began in 2021 with the mind-boggling trades of Axie Infinity, which crossed $1B in player-to-player volume and at its peak amassed over $2B in transactions with 2 million daily users.

That hype faded rapidly, NFT volumes and active wallets dropped by more than 90% in 2022, exposing speculative mechanics lacking retention or sustainability.

Despite humble beginnings, Web3 gaming has matured: nearly $162 million was raised across a dozen-plus ventures from 2023 to early 2024, daily unique gaming wallets stabilized around 4–5 million, and the global gaming NFT market holds a solid size of $4.8–4.9 billion in 2024

To The East 🇨🇳

Shrapnel just became a first mover by securing integration with China’s Trusted Copyright Chain (TCC) via GalaChain.

🚦It’s a regulatory unlock: for the first time, a Web3 shooter can issue and trade in-game NFTs legally in a market of more than 600 million gamers 🚦

That’s a potential gold rush 💎

By turning NFTs into state-recognized digital property, Shrapnel has cracked a door most global publishers can’t even get near. If it lands, Shrapnel could ignite a broader surge for the entire $5B Web3 gaming economy, setting the stage for exponential growth.

Impact 🔨

Shrapnel’s raise is uniquely significant because it’s one of the few injections into AAA-focused Web3 gaming during a period where funding is selective.

It signals a renewed institutional confidence in projects that combine high-end game design with player ownership, rather than “earn-first” gimmicks. It’s a bet on quality and retention in a market that’s shifting from flash to foundation.

And by securing state-approved rails into China’s 600 million–plus gamer base, Shrapnel is prying open the single biggest growth market for Web3 gaming 🔥

Events 📆

IRL:

Introduction.com x Silicon Valley Bank: Members only Soirée, NYC; 9/18 🗽

Coinfest Asia, Bali; 8/21-8/22 🏄♂️

Top Stories 📰

Bessent Bears on Bitcoin 🐻

The U.S. will not buy BTC for its Strategic Reserve.

Bessent’s latest comments framed the reserve as a safeguard for stability, not a bet-the-country moonshot.

Origins of the Reserve 📦

The Bitcoin reserve began under an executive order in early 2024, seeded with seized crypto assets from DOJ and IRS enforcement actions. It was pitched as a way to manage confiscated holdings transparently while shoring up long-term financial security.

The reserve is estimated at $20B, with billions more expected to surge in as additional assets are seized.

Market Ripples 🌊

When the executive order first dropped, Bitcoin popped as high as 12% in a single week, with ETH and other majors following suit. Optimism centered on the idea of state-level legitimization for crypto.

But Bessent’s latest words pulled enthusiasm back to earth, with BTC slipping a few points as markets priced in a slower, steadier hand. The signal was clear: Bitcoin may be part of the U.S. financial toolkit, but not the star of the show.

Flipside of the Coin 🪙

That duality is the story: crypto has never been closer to the core of finance, yet it has never been more sensitive to the decisions of policymakers in D.C.

Adoption is real, but so is dependence.

Ronin

Ronin: The Comeback Kid 🕹️

Ronin Homecoming 🏠

Ronin, the once Axie Infinity–exclusive chain, has officially announced its transition into an Ethereum Layer 2. What started as a sidechain workaround to avoid Ethereum’s high fees is now circling back as part of a maturing market.

By integrating directly into Ethereum’s scaling ecosystem, Ronin sheds its old vulnerabilities while keeping the gamer-first efficiency that made it famous.

This homecoming is both symbolic and strategic: the chain that was born from Ethereum now returns to it stronger than before.

A Reverse Migration — Almost One-of-a-Kind 🔄

Most blockchain projects take the opposite path, leaving Ethereum to escape congestion and fees, often migrating to Solana or launching their own standalone chains.

Ronin’s journey is unusual: it’s one of the very few chains returning to Ethereum, embracing its Layer 2 ecosystem rather than competing against it.

Only a handful of others, like Celo and Cronos, have made similar moves, but Ronin’s pivot carries outsized weight given its roots in Web3 gaming and the scars of its 2022 bridge hack. it’s a calculated rebirth aligned with Ethereum’s maturation.

By the Numbers 📊

Ronin’s growth story has been a rollercoaster 🎢

At its peak during the Axie boom, the chain supported nearly 2.7M daily active users and over $4.2B in NFT volume, making it the beating heart of Web3 gaming. But the 2022 bridge hack brought activity to a standstill, with DAUs dropping below 200K and volume evaporating.

Today, the comeback is undeniable: Ronin averages 1–2M daily active users and has surpassed $4.3B in lifetime NFT volume, outpacing its pre-hack highs. The recovery proves that its ecosystem is not just resilient but growing.

Why It Matters 🔮

If the first chapter was about avoiding Ethereum’s costs, the second is about embracing its security, scale, and shared network effects. In a world where most chains try to compete with Ethereum, Ronin’s return positions it as a Layer 2 built for gamers, liquidity, and mainstream adoption.

This move signals more than Ronin’s comeback: it’s a testament to Ethereum’s dominance and a rare acknowledgment that the real network effects now flow back to the mothership.

Kalshi x Robinhood

Robinhood Predicts huge W with Kalshi 🥳

Quick Recap 🕦

Robinhood has partnered with CFTC-regulated platform Kalshi to launch a Prediction Markets Hub inside its app, offering users trading access to NFL, college football, political, and macro event markets.

These event contracts let traders take real-time positions on outcomes rather than placing “bets,” structured more like financial derivatives than traditional sportsbooks.

Robinhood Is Not Just a Fiat On-Ramp 🎢

Robinhood isn’t acting merely as a wallet gateway; it integrates Kalshi’s order book and compliance stack into its app, executing trades, managing KYC, and processing USD settlements.

Although Kalshi handles the back-end clearing and regulatory licensure, Robinhood delivers the interface, user access, and fiat rails that mainstream customers trust and use daily.

Landscape at a Glance 🌐

Kalshi

CFTC-regulated U.S. exchange for event contracts;

raised $185M at a $2B valuation (July 2025).

Sports dominate, driving ~79% of flow with $208M traded on March Madness alone.

Polymarket

~$1.16B monthly volume at mid-2025.

U.S. users restricted post-2022 CFTC settlement.

Manifold Social

play-money markets using “Mana” instead of cash.

CME Event Contracts

Binary products for retail via brokers

not true open-ended prediction markets but target similar demand.

Volumes & Growth 📈

Kalshi

Single events can cross $200M turnover; sports now ~80% of all activity.

Polymarket

Global leader by volume with >$1B traded monthly, spiking around elections and sports.

U.S. sports betting saw $150B handle and $13.7B revenue in 2024; prediction markets remain tiny but scaling fast.

Kalshi and Robinhood First Mover Advantage 🚀

Kalshi’s CFTC license makes it the only nationwide real-money event exchange.

Robinhood’s integration of Kalshi-powered football markets marks a distribution unlock, pushing prediction markets into the retail mainstream.

Navigating Prediction Market Regulation ⚖️

Robinhood’s entry into prediction markets rides on its partnership with Kalshi, a CFTC-regulated Designated Contract Market. By leveraging Kalshi’s federal license, Robinhood sidesteps the messy, state-by-state gambling rules and offers event contracts nationwide, handling customer onboarding, KYC, and fiat settlement while Kalshi runs the exchange under federal oversight.

Still, friction remains: states like Nevada, New Jersey, and Ohio classify certain event contracts as sports betting, prompting Robinhood and Kalshi to disable access rather than fight legal battles.

It’s a strategic split, Kalshi handles regulatory defense, while Robinhood focuses on scaling UX and distribution, keeping prediction markets broadly available while navigating a complex legal landscape.

Market Reaction 🌊

After the announcement, Robinhood shares held steady, signaling investor confidence that this is a strategic expansion—not a speculative gamble. In Q2 2025 alone, users traded roughly $1 billion worth of event contracts via Kalshi-powered markets, helping Robinhood surpass $2 billion in cumulative prediction-market volume.

Early traction shows strong engagement, especially in newly launched pro and college football markets. Investors are framing this as a recurring growth lever, with event trading quickly becoming a new behavioral touchpoint inside the Robinhood app.

Looking Ahead 🔮

If prediction markets gain traction, Robinhood could build a new vertical alongside investing and crypto, potentially undercutting traditional sportsbooks by tapping into its broad retail base.’

Whether regulators push back or users embrace these offerings will ultimately dictate whether prediction markets become a core part of fintech’s future.

✨ From billion-dollar IPOs to retail-ready prediction markets, the rails of finance are shifting under our feet. Whether it’s Robinhood blurring the line between trading and betting, Mesh rewiring global payments, or Bullish rewriting exchange playbooks, the next wave of fintech isn’t coming — it’s already here.

Strap in. The markets aren’t slowing down, and neither are we.✨