Welcome to the Introduction.com newsletter

Where 🚦 Signal > Noise 🔈

You’re now reading the same newsletter trusted by founders, investors, and executives across Coinbase, Stripe, A16Z, and the top L1s in crypto

Introduction.com is a private members' network for the operators shaping this industry behind the scenes

300+ members. Zero fluff. Just direct access to what matters

(ps, we are actively reviewing applications. Keep an eye on your inbox.)

Happy Wednesday 🎉

Crypto doesn’t sleep, but sometimes it surprises you with depth.

This week’s X Post of the Week goes to @CryptoUsopp, the pseudonymous crypto informant who stirred up a rare moment of introspection across X with one simple prompt:

“Men who are more than 30, give advice to men who are in their 20s.”

What started as a casual tweet turned into a cultural flashpoint, with thousands chiming in from every corner of crypto Twitter.

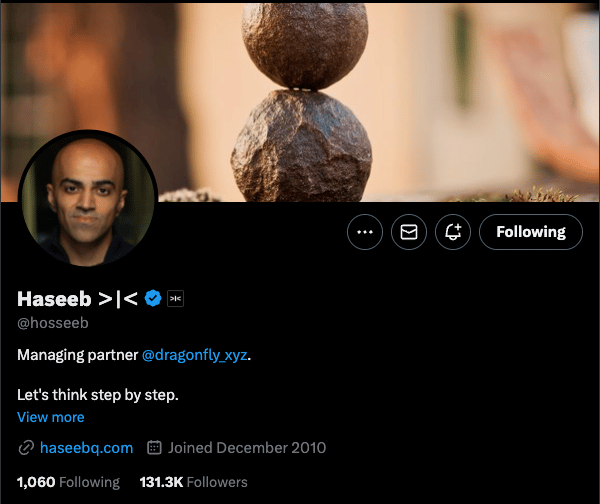

Then came the reply that anchored it all. @hosseeb, Managing Partner at Dragonfly, dropped a masterclass in wisdom with ten pieces of advice ranging from “get better at speaking” to “say yes to every adventure.”

His response reframed the thread as something more than self-improvement. It became a guide to risk, curiosity, and identity in both life and crypto.

Together, the two turned a tweet into a philosophy lesson, proof that the best content on X is not charts or tokens but moments of genuine reflection that remind this industry it is still made of people.

If you think your post has what it takes, DM us on X and maybe you will be featured next.

Introduction.com Updates (Members):

👶 New Member Announcements:

The Introduction.com team is super excited to announce the newest additions to our community this week!

(We’d love to see you up here one day🤠)

Apply Today

Kicking off this week's new members, meet Jonathan King, Senior Manager of Investments at Coinbase Ventures (@coinbase). He backs early-stage crypto and Web3 startups building the onchain economy, bringing over 11 years of experience spanning product and corporate strategy. Before joining Coinbase Ventures, JK was a Principal PM at Microsoft working on Azure cloud services for live streaming, and was also an active angel investor and member of the Atlanta Technology Angels. Welcome to the network, JK!

Next up, introducing Won Kim (@wonk1m), Chief Commercial Officer at ApeCo (@apecoin), the sister company to Yuga Labs, driving business and growth for ApeCoin and ApeChain. He's focused on building long-term, culture-focused partnerships that empower creator-first communities and help BAYC become the best club online and IRL. Before ApeCo, Won led Global Partnerships at Yuga Labs and co-founded Bored Room Ventures, bringing deep expertise in brand strategy and Web3 community building. We're thrilled to have him join the Introduction.com community!

Following in good company is Trevor Wells (@chev0r) who leads growth marketing at Gemini (@Gemini), one of the world's most trusted cryptocurrency exchanges. He's focused on expanding the exchange and driving adoption for the Gemini Credit Card, bridging traditional finance with digital assets. With nearly four years at Gemini, including leading marketing for Nifty Gateway, and entrepreneurial experience co-founding Fresh Vintage Farms, Trevor brings a diverse growth marketing background to the network. Happy to be welcoming him into the network!

Rounding out this week's new members: MVP (@BeraMVP), who's been driving business development in crypto for five years and was the first BD hire at Berachain (@berachain). Prior, he helped incubate Vertex, which reached $300B in lifetime volume before its Kraken acquisition. At Berachain, he's incubated Puffpaw, OverUnder, and Credifi while supporting hundreds of founders from idea to launch and beyond, focusing on real businesses within consumer, DeFi, and infrastructure. He also founded a community-owned charity that raised $6M for charitable causes. If you've met MVP, you'll know. Welcome, MVP!

Table of Contents

What We’re Looking at 👀

🌟 Welcome to this week’s newsletter, where money moves faster than your attention span.

Benchmark and Coinbase caught FOMO, Ripple is running with Mastercard, and Bitcoin just applied for a credit card.

Add a global policy remix and a few billion in fresh funding, and you have crypto’s version of a halftime show with no commercial breaks🌟

Money Moves(Funding/M&A): 🤑

From Introduction.com Members 💳️

Fomo

Benchmark, Coinbase and Team Had FOMO and Raised 17 million dollars for a Social Crypto Platform💡

What’s Happening 🚀

FOMO raised 17 million dollars in a Series A led by Benchmark with participation from Coinbase Ventures and several crypto native backers.

What Is FOMO 💡

FOMO is a social trading app that lets retail users discover tokens, follow wallets and top traders, and place one tap trades across Solana, Base, and BNB Chain.

Basically the X or Facebook of digital asset trading.

Founders and background

Paul Erlanger - Product and trading infrastructure background associated with dYdX

Se Yong Park - UI and consumer app experience also linked to prior work around dYdX

Both founders set out to build a mobile first trading experience that merges on chain activity with a social graph

Proof of concept

Public launch in May 2025 with fast on chain execution and Apple Pay funding through a licensed payments partner

Multiple fiat on ramps beyond Apple Pay including card rails and third party regulated providers

Social profiles show wallet activity, trades, posts, and strategies, turning trading behavior into a social signal

Strong traction during the 2025 memecoin surge, suggesting early product market fit even without public user numbers

The Raise 💰

FOMO Trading raised 17 million dollars in a Series A led by Benchmark with participation from Coinbase Ventures, Founders Fund, Archetype Ventures, and Framework Ventures, marking one of the largest early stage consumer crypto raises of 2025.

Across all investors the thesis is aligned. Retail speculation is not disappearing. It is becoming structured. FOMO is where that behavior becomes a platform.

Social Chains ⛓

These three chains dominate retail on chain activity and capture the majority of viral token volume.

Solana is the cultural home of memecoins

Base is the center of social and creator driven tokens

BNB Chain carries massive retail volume across Asia and Africa

Together they represent the highest concentration of social liquidity and retail speculation.

What We Know and What We Do Not Know 🔍

What we know

FOMO is live and processing on chain trades across Solana, Base, and BNB Chain

Fiat top ups operate through Apple Pay and regulated third party payment processors

The social layer is active with profiles, feeds, and real time trade visibility

Benchmark, Coinbase Ventures, Haun Ventures, Framework, and Archetype funded early to secure a position in social trading

What we do not know

No public user count or monthly trading volume

No clarity on long term regulatory licensing plans for the United States or Europe

Unknown whether a FOMO token will exist

Monetization is not confirmed beyond a potential spread based model

Regulatory Considerations and What to Watch 🔍

FOMO operates in a regulatory light zone.

Fiat flows pass through regulated on ramps and trades settle directly on chain, which keeps FOMO outside exchange and broker dealer licensing requirements. This works today, but it will not hold indefinitely.

What to watch

How EU MiCA treats social platforms that facilitate on chain swaps

Whether US regulators classify wallet following and trade copying as financial promotion

Whether deeper integration with Solana, Base, or BNB creates new embedded compliance responsibilities

Any move toward direct custody, which would trigger full licensing obligations

Ripple 🌊

Ripple Recap 💡

Ripple traces its origins to 2012 when Jed McCaleb, David Schwartz, and Arthur Britto created the XRP Ledger to build a faster and more efficient global settlement network.

Chris Larsen joined shortly after as an executive co founder to scale the business, drive partnerships, and build out the enterprise strategy.

🔦 Ripple’s goal is to make sending money across borders faster and cheaper by using blockchain technology instead of traditional bank systems 🔦

Company milestones

2012: Launched the XRP Ledger as a high throughput alternative to proof of work networks.

2013: Formed Ripple Labs and began signing early banking and remittance partners.

2017: Rolled out RippleNet as a unified enterprise payment and liquidity platform.

On Demand Liquidity: Introduced real time settlement using XRP as a bridge asset.

70+ Partners: Secured institutional payment customers across remittance, banking, and fintech sectors.

Expansion: Moved into tokenization, custody, and regulated financial services to broaden the enterprise stack.

The Raise 💰

Ripple raised 500 million dollars at a 40 billion dollar valuation in a round led by Fortress, with participation from Citadel Securities, Pantera Capital, and other large institutional investors (CoinDesk)

Ripple raised money to grow its global payment network, expand bank partnerships, and make XRP a key part of cross border transactions.

How the investors fit

Fortress invests heavily in financial infrastructure and saw Ripple as a scaled settlement network with real institutional utility.

Citadel Securities focuses on global market structure and liquidity and views Ripple as a gateway to the next generation of fast settlement rails.

Pantera Capital has backed blockchain payment systems for more than a decade and considers Ripple one of the few networks with genuine enterprise adoption.

How this round compares

This raise puts Ripple at the top of the payment infrastructure stack by valuation.

It is significantly larger than Tempo’s 500 million dollar Series A at a 5 billion dollar valuation and well above Circle Internet Group’s targeted 7.2 billion dollar valuation in its IPO, placing Ripple beside the largest global fintechs by private valuation.

It reinforces Ripple as a mature enterprise payment company rather than an experimental crypto project.

Looking Forward 🔮

Ripple enters its next chapter with more capital, stronger institutional backing, and a clearer path toward becoming core settlement infrastructure for banks, fintechs, and global payment networks.

The focus now is expanding on chain liquidity, deepening partnerships with payment providers, and positioning XRP Ledger as a compliance aligned settlement environment for enterprise volume.

If Ripple executes, this round cements its role as one of the few blockchain networks with real adoption, real distribution, and real institutional momentum.

Industry Leaders 🤠

Commonware

What is Happening 🚀

Tempo has made a 25 million dollar strategic investment into Commonware in a move that looks less like a standard funding round and more like a full acqui raise backed by undisclosed ecosystem partners.

What Is Commonware 💡

Commonware builds middleware infrastructure that lets developers automate stablecoin payments and launch payment optimized chains.

According to Fortune, the company is already supporting fintech pilots that move USDC payouts and settlement flows.

Customer names have not been disclosed, but the publication confirms that live integrations are underway.

The Raise 💰

Commonware secured a 25 million dollar strategic round led by Tempo, a Stripe and Paradigm backed settlement chain that is actively consolidating key infrastructure teams.

Tempo is the only disclosed investor, and Commonware has declined to name any additional participants, which strongly suggests other ecosystem players contributed quietly.

Why they wanted this round

Tempo needs chain templates, runtime modules, and developer scaffolding to accelerate adoption of its stablecoin focused settlement layer.

Commonware builds exactly that, which makes the investment a shortcut to acquiring talent, roadmap, and execution capacity.

Past raise

Commonware previously raised a 9 million dollar seed round co-led by Haun Ventures and Dragonfly Capital, positioning it as a lean, senior engineering team focused on delivering production-ready chain tooling.

(The Block)

Company Milestones 📈

Founded by Patrick O’Grady, former VP of Engineering at Ava Labs.

Built modular chain templates for high-throughput settlement networks (Commonware Blog).

Developed core primitives for applications that need custom fee markets and predictable settlement (Cointelegraph via TradingView).

Became a go-to studio for teams designing chain-level infrastructure without hiring full protocol teams (needs source).

Drew early attention from stablecoin issuers, payment networks, and emerging L1s seeking faster deployment cycles (Cryptopolitan).

The Acquraise and Why It Matters 🔍

This round looks like an acqui raise because it consolidates a specialized engineering team directly into the Tempo ecosystem without formally announcing an acquisition.

The lack of disclosed co investors implies strategic partners wanted exposure while allowing Tempo to steer the integration narrative.

The move signals that stablecoin focused chains are entering a scale phase where speed matters more than ideology.

Buying builders is faster than hiring them. And acquiring chain templates is faster than inventing them.

If Commonware becomes the internal engine for Tempo’s settlement infrastructure, this will mark one of the clearest examples of an ecosystem acquiring capability through investment rather than corporate takeover.

The story here is simple: Stablecoin rails are consolidating, and Tempo wants to own the entire stack.

Lava

Bitcoin Backs the Bank Run

Lava Secures 200 Million Dollars to Turn BTC Into a Mainstream Credit Engine

Who Is Lava 🤔

Founded in 2022, Lava is a consumer credit company building a Bitcoin-backed line of credit that looks and feels like a traditional financial product.

The vision is simple. Turn Bitcoin into productive collateral without forcing users to sell their holdings or navigate complex DeFi rails.

How It Works ⚙️

Lava offers the Bitcoin Line of Credit. Users post BTC as collateral and draw dollars when they need liquidity.

Example

A user deposits 1 BTC worth $60,000 and gains access to a credit line. They can borrow $20,000 or $30,000 without monthly payment requirements and repay whenever they choose. Their Bitcoin remains locked as collateral with automated monitoring of loan-to-value thresholds.

What makes it different

The Money 💸

The headline is the size. Lava secured a $200 million facility to fund customer borrowing and scale nationwide (CryptoRank ICO Lava-Lending).

Before this huge step, Lava had already raised $10 million in a Series A in December 2024 led by Khosla Ventures and Founders Fund (CryptoNews).

This gives Lava the capital to originate loans at scale.

The Market 🌍

Bitcoin-backed credit is heating up as multiple players try to own the category.

Competitor landscape

Ledn provides fixed-term BTC loans with starting APRs around 9.9% and limited flexibility compared to open credit lines (Ledn).

Unchained focuses on multi-sig, security-heavy structures with collaborative custody and fixed repayment schedules (Unchained).

Coinbase Borrow allows BTC-backed liquidity to select U.S. users but is not structured as a revolving consumer credit line (Investopedia).

Looking Ahead 🔮

The signal is clear. Bitcoin is shifting from a passive store of value to an active source of credit. Lava is betting millions of BTC holders want liquidity without selling their coins or navigating DeFi.

If Lava can maintain competitive rates, avoid collateral-volatility blow-ups, and secure the right licences as it scales, it could become the default credit layer for Bitcoin in the United States.

Not the Moody’s or S&P of crypto.

The credit card on top of Bitcoin.

Events 📆

IRL:

Buenos Aires, Argentina; 11/17 - 11/22 🇦🇷

Abu Dhabi, United Arab Emirates; 12/11 -12/13 🇦🇪

Top Stories 📰

Around the World 🌐

South Korea 🇰🇷 | Bybit Eyes Korbit Takeover

Bybit is reportedly in talks to acquire Korbit, one of South Korea’s major crypto exchanges with KRW fiat rails alongside Upbit, Bithumb, Coinone, and GOPAX, in a move that could give the Dubai based exchange a crucial foothold in Asia’s most active retail crypto market (CoinDesk).

Founded in 2018 by Ben Zhou, Bybit has grown into one of the world’s largest exchanges by trading volume, consistently ranking among the global top three for derivatives and top five for spot markets (CoinMarketCap). Korbit, backed by NXC (Nexon’s parent) and SK Planet, maintains a coveted Shinhan Bank partnership required for local compliance. A takeover would echo Binance’s 2025 re entry via GOPAX, signaling renewed foreign competition for Korean market share.

If finalized, the deal would fuse global liquidity with Korea’s strict but lucrative fiat rails, a potential template for cross border exchange expansion in the post MiCA era.

Hong Kong 🇭🇰 | Green Bonds Go On-Chain

Hong Kong is preparing to issue its third blockchain based digital green bond since 2023, expanding the city’s role as a global hub for tokenized securities and digital asset infrastructure (CoinDesk).

Led by the Hong Kong Monetary Authority (HKMA) and the Financial Services and the Treasury Bureau, the issuance will include multi currency tranches in USD, HKD, EUR, and offshore CNY, testing blockchain based settlement through pilot frameworks tied to e HKD and e CNY programs.

The move blends sustainability and fintech strategy, positioning Hong Kong as Asia’s sovereign sandbox for ESG finance and large scale tokenized securities.

Hong Kong 🇭🇰 | Franklin Templeton Tokenizes Money Markets

Franklin Templeton has launched a tokenized U.S. dollar money market fund in Hong Kong, expanding its OnChain product line that records fund shares directly on blockchain (CoinDesk).

The Luxembourg registered fund, backed by short term U.S. Treasuries, targets professional investors and operates in collaboration with HSBC and OSL Group as part of Hong Kong’s broader tokenization initiative (Crowdfund Insider).

Franklin Templeton previously launched the Benji tokenized fund in the United States in 2021 and a UCITS compliant version in Luxembourg in 2024, giving it an early lead among traditional asset managers exploring tokenized fund infrastructure. Goldman Sachs, BNY Mellon, BlackRock, and Janus Henderson are now following suit as competition in blockchain based money market products accelerates.

Protocol Power Plays ⚡

Uniswap | The Great UNIfication 🧬

Uniswap Labs and the Uniswap Foundation have announced a sweeping “UNIfication” proposal that merges governance, activates long awaited protocol fees, and introduces a burn of roughly 100 million UNI to align the token with real trading activity (CoinDesk). The move effectively turns Uniswap into a revenue generating protocol, where UNI holders benefit from on chain volume through deflationary mechanics and treasury accrual.

Beyond internal consolidation, the overhaul signals a turning point for DeFi as top protocols evolve from experimental collectives into self sustaining financial systems. By tying token value directly to network performance, Uniswap is setting a new standard for how decentralized applications can capture and distribute real economic yield, closing the gap between speculative governance and functional on chain business models.

Ripple 🌊

A New Wave of Credit: Ripple Makes a Splash with Mastercard 🌊💳

What’s Happening 🚀

Ripple is testing a system that lets Mastercard, WebBank, and Gemini settle credit card payments on the blockchain using its RLUSD stablecoin (CoinDesk).

Who They Are 👤

Ripple is a blockchain payments company founded in 2012 that builds global settlement infrastructure for banks, payment networks, and fintechs, now expanding into stablecoins, custody, and institutional finance.

Ripple: Company Milestones

Founded in 2012 to streamline cross-border payments using blockchain (Wikipedia).

Expanded into custody and institutional infrastructure, including the 2025 acquisition of Hidden Road to build a prime-brokerage business (Markets Media).

Launched its U.S. dollar-backed stablecoin RLUSD in December 2024 under a New York Trust Charter; circulation surpassed US$1 billion by late 2025 (BusinessWire).

In November 2025 announced a strategic collaboration with Mastercard, WebBank, and Gemini to pilot stablecoin settlement for credit-card transactions (CoinDesk).

How the Pilot Works ⚙

Ripple, Mastercard, WebBank, and Gemini are testing credit card payments that use RLUSD on the XRP Ledger (XRPL). +

Customers still pay and get paid in U.S. dollars, but behind the scenes WebBank issues RLUSD, Gemini handles the on and off ramps.

Mastercard runs the card network, allowing transactions to settle almost instantly on chain with full audit visibility.

Why This Matters 🔎

This partnership could be one of the first times a U.S. bank uses a regulated stablecoin on a public blockchain to settle card payments without changing how people pay or get paid.

By cutting settlement time from days to seconds, it could lower costs, speed up payments, and make the process more transparent, paving the way for wider use of tokenized money in everyday finance.

🧭 Regulation Roundup

🇺🇸 ETPs Can Earn Yield Without Tax Headaches

The Treasury and IRS released new guidance that lets crypto exchange traded products stake digital assets and share rewards with investors without triggering new taxes (CoinDesk).

This marks the first time regulated funds can earn on chain yield in a compliant way.

It turns staking from a gray zone into a legitimate income source for mainstream financial products.

By clearing this path, the U S positions itself as the global leader in digital asset innovation.

The move shows Washington shifting from resistance to design, setting a blueprint for how traditional markets and blockchain finance can finally work together.

Global regulators are not on the sidelines.

🇺🇸 Senate AG Drops Updated Market Structure Bill

The Senate committee released a long awaited draft to clarify agency jurisdiction and set core rules for trading, custody, and disclosures in U S crypto markets (CoinDesk).

🇬🇧 Bank of England Confirms Temporary Stablecoin Holding Caps

The central bank plans time bound limits on stablecoin holdings during the initial roll out to manage risk while systems and supervision scale up (CoinDesk).

🇺🇸 CFTC Adjacent Regulator Moves Toward Spot Market Oversight

A U S markets regulator that may take the lead on digital assets is pushing toward a framework for regulated spot trading (CoinDesk).

🇺🇸 State of Crypto – SBF Has Another Bad Day in Court

Court developments underscore ongoing U S prosecutorial pressure around fraud and market integrity in high profile crypto cases (CoinDesk).

🇺🇸 Fed Official Flags Stablecoin Boom To Three Trillion

Federal Reserve Governor Adriana Kugler Miran says policy needs to adapt to a stablecoin market that could reach three trillion dollars and touch payment rails at scale (CoinDesk).

🇯🇵 Japan Regulator Backs Megabanks on Stablecoin Issuance

Japan’s watchdog will support the three largest banks as they pilot compliant stablecoin products for domestic and cross border use (CoinDesk).

🇺🇸 Samourai Wallet Developer Sentenced to Five Years

A U S court handed down a five year sentence for operating an unlicensed money transmitting business tied to a privacy wallet service (CoinDesk).

🇬🇧 UK Stablecoin Rules Coming As Quickly As The U S

The Bank of England says the United Kingdom will move at U S speed to finalize a stablecoin regime for issuance and payments (CoinDesk).

🇮🇪 Central Bank of Ireland Fines Coinbase $24.6 Million

Ireland’s central bank issued a significant penalty for anti money laundering failures tied to monitoring and reporting obligations (CoinDesk).

🇺🇸 Trump Says He Wants U S To Be Bitcoin Superpower

Policy signaling continues as the former president calls for leadership in digital asset competitiveness relative to China (CoinDesk).

🇨🇦 Canada Begins March Toward Stablecoin Framework

Canadian officials are mapping a path to comprehensive stablecoin rules covering issuance, custody, and redemption protections (CoinDesk).

🇧🇲 Chainlink and Apex Group Test On Chain Stablecoin Compliance

A live pilot with Bermuda’s regulator explores programmable controls for issuer compliance and real time monitoring of stablecoin flows (CoinDesk).

🇺🇸 MEV Bot Trial Ends In Mistrial

A U S jury deadlocked in a closely watched case about on chain transaction tactics and alleged hacking which could shape future enforcement boundaries (Cointelegraph).

🇦🇺 ASIC Warns Australia Risks Missing Tokenisation Opportunity

The securities regulator says Australia must move faster on tokenised assets or lose ground in capital markets innovation (Cointelegraph).

🇮🇪 Coinbase Settles With Ireland Over Monitoring Errors

Coinbase reached a settlement addressing compliance lapses related to transaction surveillance and reporting in the Irish market (Cointelegraph).

🇺🇸 Court Says FBI Cannot Be Blamed For Wiping Hard Drive With $345 Million In Bitcoin

Judges ruled the agency is not liable in a case over destroyed storage media allegedly holding a vast bitcoin trove (Cointelegraph).

🇺🇸 Senate Proposal Would Give CFTC Reach Into Crypto Spot Markets

New legislation would expand the commodities regulator’s remit to supervise spot trading in digital assets alongside derivatives oversight (Decrypt).

🇯🇵 Japan’s Largest Banks Get Greenlight For Stablecoin Trial With March 2026 Target

Regulators approved a path for major banks to test stablecoins with an eye to a full launch by March 2026 (Decrypt).

The takeaway

The policy arc is converging. Stablecoins are getting caps, pilots, and full frameworks while U S lawmakers and regulators sketch the contours of spot market supervision. Enforcement and court outcomes continue to define edges in privacy, trading, and compliance. The next test is translating drafts and pilots into production grade rules that scale without breaking market plumbing.

Wrap Up ✌

✨From FOMO to Ripple’s mega round, the message is clear.

The institutions have arrived and they brought deep pockets.

Stablecoins are scaling, AI is paying its own bills, and regulators are finally speaking fluent crypto so keep your coffee close and your notifications on✨