Welcome to the Introduction.com newsletter

Where 🚦 Signal > Noise 🔈

You’re now reading the same newsletter trusted by founders, investors, and executives across Coinbase, Stripe, A16Z, and the top L1s in crypto

Introduction.com is a private members' network for the operators shaping this industry behind the scenes

300+ members. Zero fluff. Just direct access to what matters

(ps, we are actively reviewing applications. Keep an eye on your inbox.)

For all Introduction.com members at DevConnect this week, we're excited to invite you to the Sunset Closing Party we're hosting with MomentumX.

The closing party is an invitation-only sunset event in a refined environment with exceptional people: a night designed to stay off the record.

Non-Members: Request your invitation to be considered.

Happy Wednesday 🎉

Crypto may be volatile, but the culture is undefeated.

This week’s X Post of the Week comes from Polymarket who shared one of the most surreal crossover moments of the year: the Crown Prince of Saudi Arabia casually referencing the viral Polymarket bet about whether he would wear a suit and tie.

Simulation confirmed? At this point, probably.

Prediction markets aren’t just side quests for degens anymore.

When a head of state jokes about a Polymarket bet, it’s a signal that these platforms are becoming cultural infrastructure, not just trading venues.

If you think your post has what it takes, DM us on X and maybe you will be featured next.

Introduction.com Updates (Members):

👶 New Member Announcements:

The Introduction.com team is super excited to announce the newest additions to our community this week!

(We’d love to see you up here one day🤠)

Apply Today

First up, meet Ryan Murunge from the Digital Assets team at Goldman Sachs (@GoldmanSachs), where he focuses on crypto trading. He brought years of retail crypto experience and transitioned his passion into his career, now driving business development, strategic client onboarding, and product strategy for the firm's crypto derivatives trading desk. Before joining the Digital Assets team, he worked in multi-asset wealth management and credit risk at GS, bringing a deep understanding of both traditional and decentralized finance to the network. Welcome, Ryan!

Introducing Brian Kang, Co-Founder of White Castle Ventures, a cross-border advisory and investment firm focused on AI, energy, defense, and blockchain. With over 10 years of experience in blockchain, investments, and business development, Brian also co-founded Korea Blockchain Week, one of Asia's largest and most influential blockchain conferences. He's also the founder of faith-driven ventures and global missions, and co-founded FACTBLOCK, Korea's leading Web3 ecosystem builder dedicated to driving blockchain adoption through education and community development. We're excited for him to join the Introduction.com community!

Following in good company, meet Alex Cavallero (@apcavallerooo), Co-Founder and COO of Kii Global (@KiiChainio), an onchain foreign exchange engine powering cross-border payments using non-dollar stablecoins. After working in traditional finance and private equity, Alex co-founded a biopharmaceutical company that scaled to eight countries across Latin America. When clients started paying in USDT, he pivoted to crypto, building market-making operations and eventually KiiChain. His work focuses on bridging traditional finance with decentralized infrastructure across emerging markets, and we're thrilled he's a part of the Introduction.com crew!

Follow Alex on X and LinkedIn!

Bringing more co-founder momentum to the network, introducing Azeem Khan (@azeemk), Co-Founder of Miden (@MidenLabs), a ZK chain focused on practical privacy for the future of finance. Miden raised a $25M seed round from a16z crypto, 1kx, and Hack VC earlier this year and is positioning itself as private Ethereum. With over 12 years in crypto, Azeem previously spent two years at Gitcoin DAO leading BD, sales, and partnerships, where he distributed $15M in grants and launched one of the first super chains on the OP Stack. He also writes for Coindesk and Forbes, bringing deep ecosystem knowledge and institutional relationships to the network. Welcome to the community, Azeem!

Next on deck, meet Alan Curtis (@AlanJamesCurtis), Founder and CEO of The Invention Network (@TheInventionNet), a global community for inventors (coming out of stealth). Alan recently raised $4M from Breyer Capital and is building what aims to be the leading AI invention network, enabling every inventor—from the PhD at MIT to the single mom in Lagos to the 14-year-old in Bangalore—to create, build, and own what they bring to life. Previously, he served as COO at Eigen Labs (@eigenlayer) and Head of Platform at Blockchain Capital, where he spent over five years supporting founders and building ecosystems. With five companies built and sold and investments in 50+ inventors under his belt, we're excited to have him join. Happy you're here, Alan!

Wrapping up this week, meet Jan Strandberg (@jan_web3s), Co-Founder and CEO of Acquire.Fi (@Acquire_Fi), a leading platform for Web3 M&A, OTC, and secondary market deals. Since launching Acquire.Fi, Jan has built a marketplace connecting buyers and sellers of crypto businesses, intellectual properties, and communities. With over 10 years in crypto, he previously served as Vice President of Growth at Paxful, scaling the customer base to 4.5 million users and weekly revenues to over $44 million, and co-founded YIELD App, reaching $500 million in managed assets within six months of launch. Jan has raised eight figures across funding rounds, OTC deals, and M&A transactions throughout his career. Welcome, Jan!

Table of Contents

What We’re Looking at 👀

🌟 Seismic is bringing encrypted rails to fintechs, Lighter is posting exchange scale volume in weeks, and Acurast is turning everyday devices into a confidential compute network.

Kyuzos is going from cute to culture while JPMorgan, Polymarket, and Ivy League endowments push crypto further into the mainstream.

It is a big week and the signal is loud🌟

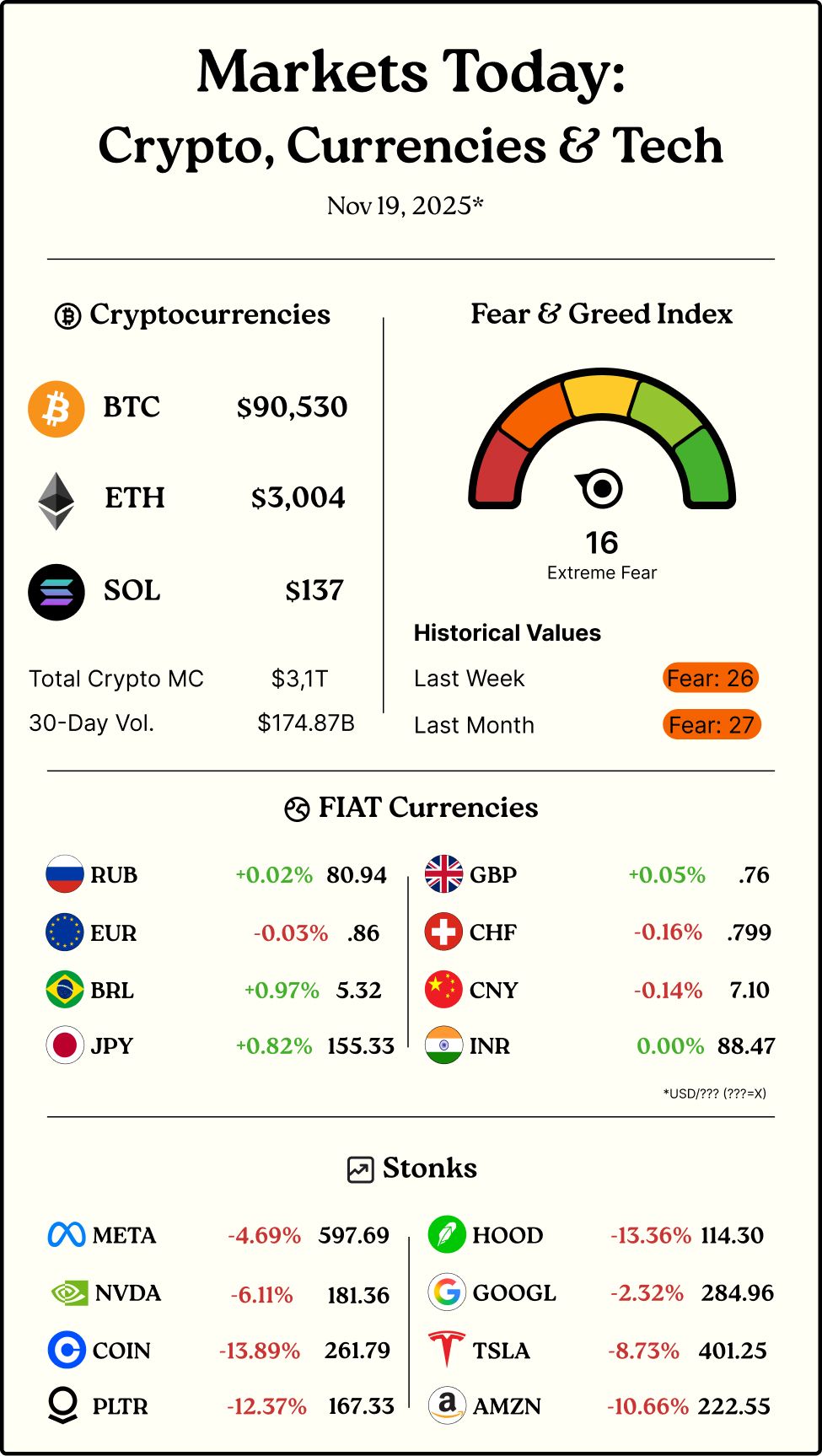

Money Moves(Funding/M&A): 🤑

From Introduction.com Members 💳️

Seismic Shakes Up the Blockchain Landscape with Programmable Privacy Bedrock 🚀

Seismic raised 10 million dollars to build encrypted blockchain rails for fintechs and financial institutions.

Privacy is no longer a feature. Seismic is turning it into infrastructure.

What Is Seismic 💡

Seismic is a blockchain where data stays private by default while still being programmable, auditable, and enterprise ready.

It lets fintechs build on chain without putting customer information on the public internet.

Founded by Lyron Co Ting Keh, Seismic has moved fast.

The team shipped a custom Reth client in October 2024, began private pilots with fintech partners in early 2025, and publicly announced its 10 million dollar round in November 2025.

The Raise 💰

Seismic raised 10 million dollars in November which brings total funding to roughly 17 million dollars.

The round was led by a16z Crypto with Amber Group, Polychain, and 1kx joining in.

Investors are making a simple bet.

Fintechs will need encrypted on chain rails as compliance tightens and Seismic is the first chain designed for that world.

Competitor Landscape 🌐

Seismic is building where almost no one else is.

A few projects touch the edges, but none targeting the specific surface area of a fintech ready stack.

Aleo pioneered private smart contracts and continues to set the standard for privacy-preserving computation, though its focus remains broader than Seismic’s fintech-specific compliance stack

Aztec supports private transactions but is not built for regulated financial workflows

R3 Corda offers enterprise privacy but runs as a permissioned network, not a public chain

The category is not crowded. Seismic is writing the spec.

What We Know vs What We Do Not Know 🔍

What we know

• Seismic uses shielded data types at the protocol layer

• It is EVM compatible and designed for fintech and regulated markets

What we do not know

• Whether Seismic will be classified as a Layer One or a specialized Layer Two

• Which enterprise partners are active and how much volume they are pushing

• The regulatory path Seismic plans to follow across regions

• Token design, validator structure, and long term incentives

Takeaway and Looking Ahead

Seismic is building for banks, fintechs, and regulated capital.

If it delivers, Seismic becomes the encrypted foundation layer for financial institutions worldwide.

The next proof points to watch are enterprise partnerships, regulatory approvals, and a public token model.

Lighter 🔥

Vunderkind Vladimir Novakovski Is At It Again. This Time In Crypto Derivatives 🧠

Lighter just raised $68M bringing total known funding to nearly $90M. This new round values the company around $1.5B.

Vladimir Novakovski Put the W in Wunderkind 🏆

Harvard W

Vladimir Novakovski studied mathematics and computer science at Harvard and began stacking wins early, long before most people pick a major.

Citadel W

He entered quantitative finance at Citadel where he worked on high performance trading systems and built a reputation for solving complex market problems that move real volume.

Lunchclub Founder W

He cofounded Lunchclub in 2017 which became one of the fastest growing professional networking platforms of the decade. It raised at least $28.8M publicly with participation from Andreessen Horowitz and may have raised up to $55.9M across undisclosed rounds.

Hypergrowth W

Lunchclub exploded during the pandemic and delivered millions of introductions, proving Vlad could scale a consumer network from zero to global adoption.

Team Loyalty W

Most of Lunchclub’s senior engineering and product team followed him to Lighter which is one of the strongest founder signals you can get.

Lighter Founder W

Now he is building Lighter, a high performance layer two and perpetuals exchange already reporting billions in daily trading volume only weeks after launch. Another arena. Another W.

What Is Lighter and Why It Matters 💡

Lighter is an L2 DEX.

It is a blockchain built specifically for trading crypto derivatives at extreme speed.

If you want a lecture on derivatives, DM me. Otherwise just know this is where traders go long or short with real leverage and real liquidity.

Other perps DEXs exist, but Lighter’s value add is simple.

It is faster, it handles more volume, and it was engineered from day one to serve the highest performance traders without blowing up the chain.

It uses a bespoke rollup, custom matching logic, and zero knowledge proofs to keep settlement fast and verifiable.

By the Numbers 📊

Lighter is not a concept. It is posting real exchange scale metrics.

Key reported numbers

• About 403 thousand users

• More than $1.16B in total value locked

• About 1.75 billion dollars in open interest

• More than 10.6 billion dollars in 24 hour trading volume at the time of reporting

Market positioning

Media outlets already rank Lighter among the highest volume perpetuals exchanges, competing with platforms like Hyperliquid.

Blockbeats reports that Lighter’s rollup became the fourth largest layer two by TVL shortly after launch which means traders and LPs are not just testing the chain. They are parking capital there.

What We’re Waiting On ⚠

What we do not know

• Full regulatory exposure across major jurisdictions.

• The long term mechanics of the LIT token.

• Risk controls such as liquidation engine parameters and insurance fund size.

• Revenue model clarity beyond the rollup and exchange fees.

Looking Ahead 🔮

Lighter is moving fast and delivering numbers that most exchanges never reach. The real narrative is the founder behind it.

If you believe in Vladimir Novakovski, you believe in Lighter.

Industry Leaders 🤠

Is the Future of Web3 a Giant Decentralized Supercomputer or Millions of Phones Doing Micro Compute 🔮

What is happening ❓

Acurast has raised more than $14M across equity and token rounds to power confidential micro compute on everyday devices.

It is not chasing the GPU mega trend. It is building the small but essential compute layer Web3 actually needs.

Why It is Different 💡

Web3 once imagined a world where every device contributed to one global computer.

Acurast is one of the few teams still pursuing that vision, but in a smaller and more practical way.

Acurast turns smartphones and edge devices into a confidential compute network that runs tiny, sensitive tasks privately.

These include secure key signing, private AI inference, encrypted data handling, and micro workflows that cannot run on public blockchains or GPU marketplaces.

It is not about massive AI jobs or heavy compute. Acurast owns the micro niche where privacy, verifiability, and low cost matter more than raw power.

The Raise and Why Investors Care 💰

Acurast publicly reports $11M raised to date, but external databases tracking token sales and undisclosed allocations place total funding closer to $25M.

The gap reflects capital that has entered the ecosystem outside of the published equity rounds.

Investors are betting that as wallets, fintechs, identity systems, and IoT platforms scale, they will need a confidential compute layer that keeps sensitive operations off chain.

Acurast is the only network built specifically for micro compute with privacy by default, which makes it an infrastructure bet rather than another GPU speculation play.

What We Know, What We Do Not, and Why It Matters 🔍

What we know:

• The network is already live and processing confidential micro compute

• Tasks run through secure enclaves on phones and publish verifiable proofs

• Developer demand is emerging in privacy heavy markets like fintech and identity

• Funding size shows real institutional conviction in the niche

What we do not know:

• How large the device network can grow

• How sustainable operator economics will be at scale

• Whether micro compute can expand into more demanding AI workloads

Takeaway:

Acurast is not trying to beat AWS or win the GPU race. It is building the quiet layer underneath Web3 where sensitive compute actually runs. If the decentralized future emerges at the edges first, it probably starts with tasks exactly like these.

Events 📆

Introduction.com Members Only Closing Party:

For all Introduction.com members at DevConnect this week, we're excited to invite you to the Sunset Closing Party we're hosting with MomentumX.

This is a closed-door experience inside a historic estate in Barrio Parque, created for a select circle of founders, investors, creators, and cultural leaders.

The closing party is an invitation-only sunset event in a refined environment with exceptional people: a night designed to stay off the record.

Non-Members: Request your invitation to be considered.

Dress code: Cocktail Attire

IRL:

Buenos Aires, Argentina; 11/17 - 11/22 🇦🇷

Buenos Aires, Argentina; November 20 @ 7:00pm 🕺

Buenos Aires, Argentina; November 19 (Today!) @ 11:00am 🔐

Abu Dhabi, United Arab Emirates; 12/11 -12/13 🇦🇪

Top Stories 📰

JPMD 🪙

JPMorgan Upgrades Dollars With Deposit Tokens On Base

What’s Happening 🗞

JPMorgan has launched its new institutional deposit token JPMD, enabling near instant dollar settlement over Coinbase’s Base network for corporate and financial clients.

What is it❓

JPMD is a blockchain based representation of real deposits held at JPMorgan. giving institutions programmable bank money that settles in seconds instead of days.

Unlike public stablecoins, JPMD keeps dollars on JPMorgan’s balance sheet, integrates directly with corporate treasuries, and runs with full bank grade compliance and KYC controls.

Key Features

One to one claim on regulated bank deposits

Live on Base for low cost transaction finality

Always on settlement for institutions

Smart contract compatibility for automated financial workflows

Backed by JPMorgan’s global payments infrastructure

Why Not Use USDC Instead 📊

Stablecoins like USDC move fast but sit outside the banking system, which means deposits leak from bank balance sheets and lose integrated treasury functionality for enterprise clients.

Because JPMD represents a standard bank deposit, JPMorgan can still lend against those balances exactly as it would with traditional corporate deposits.

Clients keep instant settlement on chain while the underlying dollars remain inside JPMorgan’s balance sheet where they continue to power the bank’s lending and liquidity operations.

Why It Matters 🔎

JPMorgan just moved bank money onto a public chain and created a compliant alternative to stablecoins for institutions that need speed without sacrificing regulatory clarity.

This positions JPMD as a new settlement rail for tokenized assets, corporate treasuries, and global payments while pushing the rest of TradFi toward blockchain based settlement.

Polymarket x UFC 👊

Prediction Market Juggernaut Takes Another Jab at Vegas 💡

What’s Happening 📰

Polymarket secured an official partnership with the UFC to power real time fight prediction markets and display live fan sentiment on broadcast and in arena screens.

Inside the Announcement 🚨

The partnership was unveiled through coordinated announcements from Polymarket and TKO Group Holdings, signaling the UFC’s first official step into on chain prediction markets.

The deal caps a breakout year for Polymarket as it cements itself as the highest volume prediction platform in crypto history.

Milestones This Past Year

Polymarket became the exclusive prediction market data provider for Yahoo Finance through a new “prediction market hub” integration.

PrizePicks signed a multi year partnership with Polymarket to bring real time event contracts into its fantasy sports ecosystem.

Onyx Odds and Polymarket launched a collaboration to offer CFTC regulated prediction contracts for commodity futures trading.

Based Exchange integrated Polymarket’s trading rails into its mobile first exchange platform to expand on chain prediction access.

By The Numbers 📊

Polymarket’s current run rate exceeds $3B in monthly volume, putting it on a trajectory north of $30B annually if sustained.

Nevada’s total annual sports betting handle sits at roughly $8B, making Polymarket’s recent activity multiple times larger than all Vegas sportsbooks combined.

UFC pay per view events frequently draw more than 10 million global viewers across broadcast, streaming, and social channels, giving Polymarket a distribution surface far wider than traditional sportsbooks.

Why This Matters 💹

Polymarket already commands the largest, fastest moving prediction markets in the world, and tapping into UFC’s broadcast footprint gives it a new lane into mainstream sports audiences.

This partnership pushes prediction markets from niche crypto behavior to mass entertainment, expanding Polymarket’s cultural reach while challenging Vegas for attention in real time fan engagement.

Brains Buy BTC 🧠

What’s Happening 📺

Harvard University and Emory University have both disclosed significant Bitcoin ETF positions, marking the first time two major U S university endowments have visibly added direct crypto exposure to their public portfolios.

The Bigger Picture 🖼

University endowments have been quietly immersing themselves in crypto and Web3 for years, through both direct holdings and allocations to blockchain focused venture funds.

What We Know So Far 🤓

Direct or ETF related exposure

Harvard University publicly disclosed large holdings in BlackRock’s Bitcoin ETF, making it one of the most prominent academic adopters (CoinMarketCap Academy).

Emory University became the first U S university endowment to report direct Bitcoin ETF exposure and has since expanded those holdings.

Crypto venture fund exposure

Yale allocated to leading crypto venture firms such as Paradigm and a16z Crypto as early as 2018.

Stanford participated in crypto venture funds during the first major institutional wave.

MIT and University of Michigan have been cited in endowment research as having meaningful blockchain related fund exposure.

Brown and Cornell appear in analyses tracking endowments with early or indirect crypto exposure.

Why It Matters 🌟

The academic establishment is no longer watching crypto from the sidelines, it is allocating to it, and these early endowment disclosures signal a broader shift toward long term institutional ownership of digital assets.

🧭 Regulation Roundup

Global regulators are not on the sidelines.

From tax surveillance to cross border stablecoin pilots, governments, courts, and agencies are turning crypto policy from abstract debate into hard rules and enforcement.

🇺🇸 White House Eyes Global Crypto Tax Reporting

The White House is reviewing a proposed rule that would let the Internal Revenue Service access data on U S taxpayers digital asset transactions in foreign jurisdictions under the global Crypto Asset Reporting Framework (CARF) (The Block).

🇺🇸 Crucial Year Ahead For U S Crypto Oversight

SEC Chair Paul Atkins signaled that the next twelve months will be critical for implementing the new U S crypto framework after the recent government shutdown and that agency rulemaking will focus on market structure and investor protections (The Block).

🇺🇸 SEC Plan To Clarify Which Tokens Are Securities

A new plan from SEC leadership aims to spell out when digital assets are tied to investment contracts and therefore fall under securities rules giving the industry long awaited guidance on token classifications (The Block).

🇯🇵 Japan Moves On Crypto Tax Relief

Japan isn’t just talking reform, its Financial Services Agency is reportedly preparing to reclassify more than one hundred cryptocurrencies as financial products while cutting the top tax rate on crypto gains from fifty five percent to twenty percent to match stock income (The Block).

🇭🇰 Hong Kong Tests Real World Tokenisation

Hong Kong has launched a pilot for real value tokenisation using traditional financial assets as test cases, moving beyond theory to see how regulated token markets perform in practice (The Block).

🇸🇬 Singapore Trials Tokenised Bills And Central Bank Money

The Monetary Authority of Singapore is trialling tokenised commercial bills alongside a wholesale central bank digital currency to test programmable settlement inside the existing financial system (The Block).

🇰🇷 Korean Bank Uses Stablecoin For Tax Refunds

South Korean bank NH NongHyup ran a government backed pilot that used a stablecoin on Avalanche to deliver tax refunds showing how public sector payouts might move on chain under regulatory supervision (The Block).

🌐 White House Mulls Taxing Foreign Crypto Accounts

U S officials are considering rules that would tax foreign crypto accounts under CARF bringing overseas digital asset holdings into a global reporting and tax net similar to existing bank account regimes (Cointelegraph).

🇺🇸 Crypto Friendly Firm Cleared To Buy U S Bank

LevelField won approval to acquire a Chicago community bank giving a crypto focused firm a regulated banking charter and a path to offer insured deposit products alongside digital asset services (Cointelegraph).

🇺🇸 BNY Mellon Stablecoin Reserve Fund For Regulated Issuers

BNY Mellon is launching a stablecoin reserves fund designed to hold assets for regulated U S issuers which could become a template for compliant backing of dollar tokens (Cointelegraph).

🇯🇵 Japan Reclassifies Crypto In Broader Regulatory Push

Japan is pairing its tax overhaul with clearer classification of digital assets as part of a wider push to integrate crypto into formal financial law rather than treat it as a fringe asset class (The Block).

🌍 ICIJ Maps Crypto Shadow Finance In Coin Laundry Report

Investigative group ICIJ published a sweeping report called Coin Laundry that traces how crypto has been used in money laundering terror finance and sanctions evasion putting pressure on regulators to tighten controls on mixers exchanges and payment services (CoinDesk).

🇺🇸 DOJ Targets North Korea Crypto Networks

The U S Department of Justice announced fresh actions against North Korean money laundering operations including new crypto seizures as part of a wider effort to disrupt the countrys illicit revenue channels (CoinDesk).

🇺🇸 Justice Department Details North Korean IT Worker Scheme

Prosecutors say U S citizens helped North Korean information technology workers slip into one hundred thirty six companies giving the regime hidden access to global firms and related crypto pay flows (The Block).

🇺🇸 Strike Force Created To Fight Pig Butchering Scams

A new U S strike force will work across agencies to target overseas pig butchering fraud rings as authorities also sanction a Burma based operation that used crypto to move stolen funds (CoinDesk).

🇺🇸 Trump Nominee Heads Toward CFTC Hearing

Crypto lawyer Mike Selig is set for a confirmation hearing to join the Commodity Futures Trading Commission as a commissioner at the same time that a major digital asset bill advances in Congress (CoinDesk).

🇺🇸 SEC Chief Promises Clarity On Crypto Investment Contracts

SEC Chair Paul Atkins said the agency will give clearer guidance on when crypto assets are linked to investment contracts which should help determine what falls inside full securities oversight (CoinDesk).

🇺🇸 Analyst Says U S Crypto Rules Put Nation In Lead

Research firm Bernstein argues that the emerging U S crypto framework now positions the country as the global leader in digital asset regulation and market structure despite ongoing political fights (CoinDesk).

🇺🇸 Court Clears FBI In Lost Bitcoin Case

A U S court ruled that the Federal Bureau of Investigation cannot be held responsible for wiping a hard drive that allegedly contained three hundred forty five million dollars worth of bitcoin rejecting the owners claim for damages (Cointelegraph).

🇺🇸 Community Bankers Push OCC To Block Sony Crypto Bank Bid

The Independent Community Bankers of America asked the Office of the Comptroller of the Currency to reject Sonys plan for a crypto focused national bank arguing it would pose competitive and regulatory risks to smaller lenders (Decrypt).

The takeaway

Regulation is no longer a side show, it is the main event.

The U S is pushing toward global tax reporting standards clearer token classifications aggressive enforcement and new agency leadership while Asia and Europe test tokenisation pilots tax reform and bank backed stablecoin models.

What happens next will determine whether crypto becomes a tightly supervised extension of existing finance or a parallel system that regulators chase from scandal to scandal.

Wrap Up ✌

✨Privacy chains are maturing, derivatives are exploding, and even universities are quietly stacking Bitcoin.

Regulators are tightening the screws while builders keep shipping.

Stay sharp because the next wave is already forming✨